Noisy wiper blades are a common cause of customer complaints in the auto parts business. While specific return rates for this issue are unclear, overall automotive parts returns r...

More

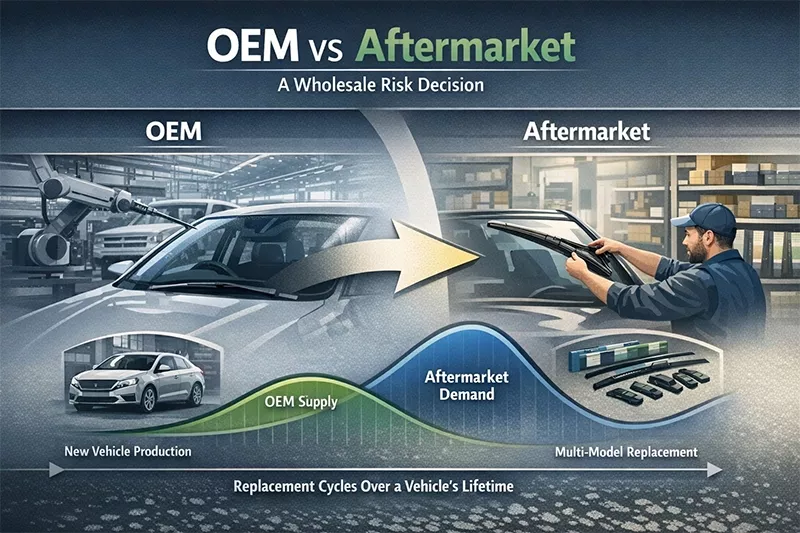

For windshield wiper distributors, the choice between OEM and aftermarket wiper blades is rarely a theoretical discussion. In real procurement scenarios, it usually comes down to one question: which option causes fewer problems after the products reach the market.

Pricing matters, but so do fitment complaints, replacement frequency, and follow-up service costs. These factors tend to show up weeks or months a...

More

North America is unforgiving to suppliers who can’t quantify failure. Service shops here don’t complain emotionally — they complain economically. A single wiper comeback can cost a shop $40–70 in technician time, fuel reimbursement, and disrupted throughput, depending on region and vehicle type. Multiply that by 20 callbacks a month, and it becomes clear why procurement teams obsess over complaint rates.

For repair chains and retail-service counters, wiper blades are evaluated on three ...

More

The Middle East doesn’t ask whether aftermarket demand will grow — it asks how fast suppliers can adapt. Vehicle age in the region continues climbing, and extreme climate exposure is compressing replacement cycles. Recent market analysis places the Middle East & Africa at roughly 10% of the global windshield wiper system market in 2025 (source), driven largely by environmental wear rates and expanding fleets.

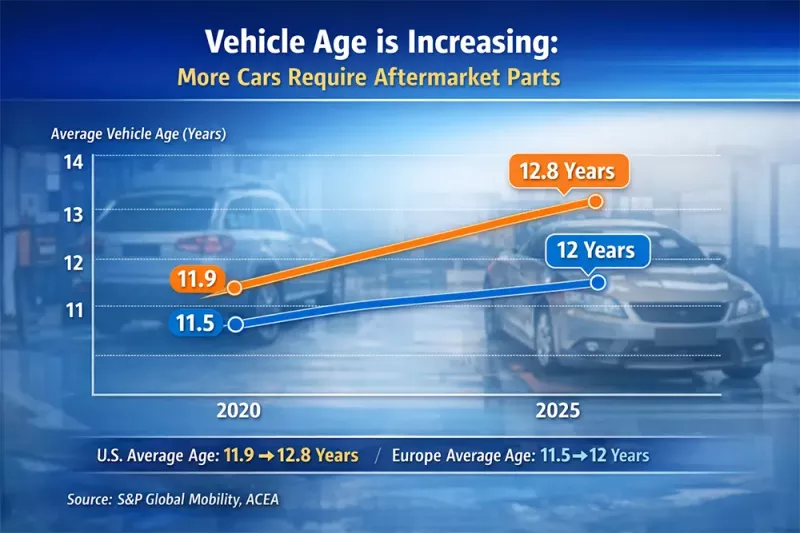

The world’s cars are getting older. According to S&P Global Mobility, the average age of vehicles on U.S. roads has risen to 12.8 years in 2025, marking a historic high. In Europe, ACEA reports an average of around 12 years. This ageing fleet means more vehicles are moving out of warranty and into a segment that requires regular maintenance and parts replacement — a prime opportunity fo...

More