For windshield wiper distributors, the choice between OEM and aftermarket wiper blades is rarely a theoretical discussion. In real procurement scenarios, it usually comes down to one question: which option causes fewer problems after the products reach the market.

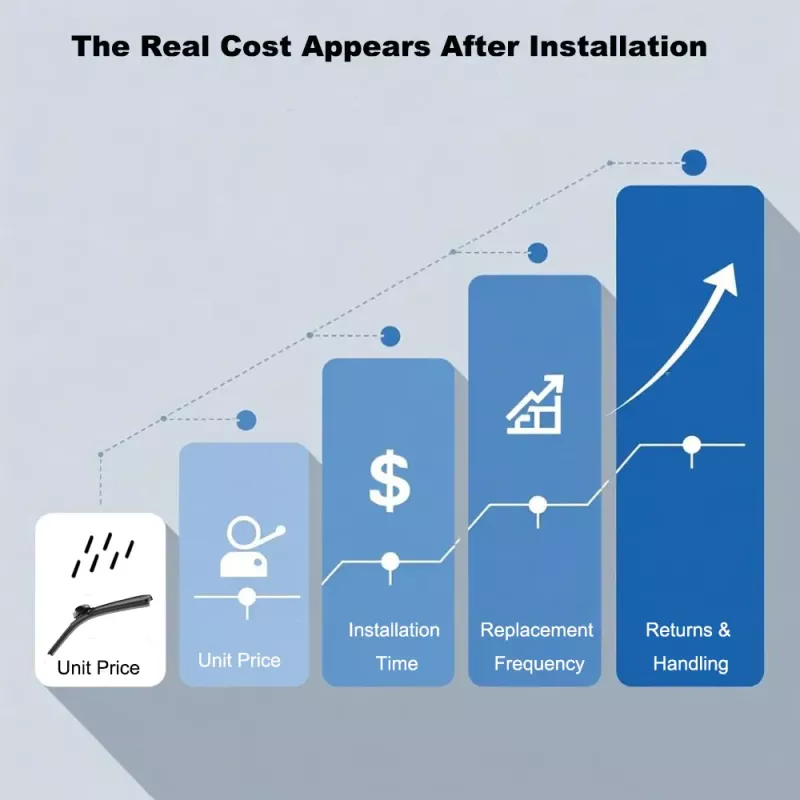

Pricing matters, but so do fitment complaints, replacement frequency, and follow-up service costs. These factors tend to show up weeks or months after delivery — often when the initial unit cost has already been forgotten. That’s why many wholesale buyers reassess OEM vs aftermarket decisions based on market behavior, not just product specs.

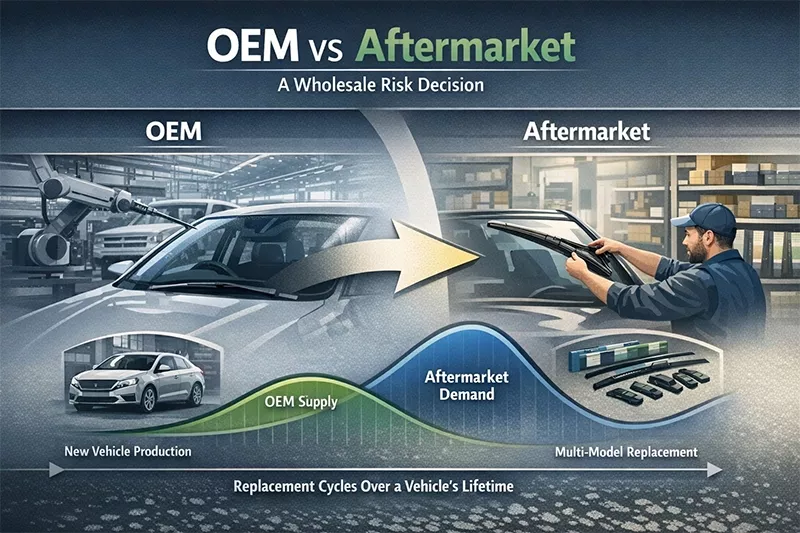

The global windshield wiper blade market is broadly divided into OEM supply and aftermarket replacement demand. OEM blades are installed during vehicle production, while aftermarket blades account for most replacements throughout a vehicle’s service life.

Public market data suggests that aftermarket demand slightly outweighs OEM supply, mainly because wiper blades are replaced multiple times during vehicle ownership. This replacement-driven demand explains why wholesale and distribution channels remain heavily aftermarket-oriented.

OEM wiper blades are produced to meet vehicle manufacturer specifications and are typically installed on new vehicles. They are designed for exact fitment, consistent wiping angles, and predictable performance aligned with original vehicle design.

In wholesale terms, OEM-grade products are often chosen to minimize compatibility risk, especially in markets where installation errors or callbacks carry a high cost.

Aftermarket blades are produced by independent manufacturers and designed to cover multiple vehicle models. They offer broader compatibility and more pricing flexibility, which is why they dominate the replacement market.

That said, quality levels vary significantly between suppliers, making supplier selection and batch consistency more important than the aftermarket label itself.

In North America, aftermarket wiper blades are widely accepted due to frequent replacement cycles and strong retail distribution. Wholesale buyers often focus on availability, price control, and broad vehicle coverage, especially for service chains and parts retailers.

European buyers tend to place more weight on fitment accuracy and complaint reduction, particularly in markets where labor costs are high. OEM-grade or OEM-fit aftermarket blades are often preferred to avoid returns and warranty issues.

Regional market studies show that while aftermarket demand is strong globally, buyer expectations differ significantly by region, affecting procurement strategies.

OEM blades generally come with a higher unit price due to vehicle-specific engineering and stricter production controls. Aftermarket blades are usually more affordable at first glance, especially in bulk orders.

However, wholesale buyers often find that price differences become less clear once complaint handling and replacement rates are considered.

Lower-priced blades may require more frequent replacement or generate more fitment issues. For distributors and workshops, this can translate into additional labor, returns, and inventory management costs.

Industry purchasing guides consistently recommend evaluating total lifecycle impact, not just unit pricing, when sourcing wiper blades in volume.

There is limited public data that isolates return costs specifically for wiper blades. However, broader supply-chain research shows that returns and reverse logistics are among the most margin-eroding factors for aftermarket distributors.

In practice, distributors rarely choose exclusively between OEM or aftermarket. Instead, they evaluate which option performs more reliably in their specific sales channels.

Reducing complaints is a priority

Fitment accuracy is critical

Warranty exposure needs to be controlled

Aftermarket solutions make sense when:

Price sensitivity dominates the market

Broad compatibility is required

Supplier quality control has been verified

Many wholesalers ultimately carry a mixed portfolio, adjusting product selection by region, channel, and customer type.

Before committing to large-volume purchases, experienced buyers typically:

Request batch-level testing results

Confirm vehicle coverage relevance for their market

For wholesale buyers, the OEM vs aftermarket decision is less about definitions and more about how products behave once they leave the warehouse. The right choice depends on regional expectations, service costs, and how much risk a distributor is willing to absorb after delivery.

Understanding these trade-offs allows buyers to source wiper blades that support long-term business stability, not just short-term pricing advantages.

Need a second opinion on your wiper blade sourcing?

Use the chat icon or email enquiry@xmyujin.com

— We’re happy to discuss market fit, complaint risk, and supply consistency.