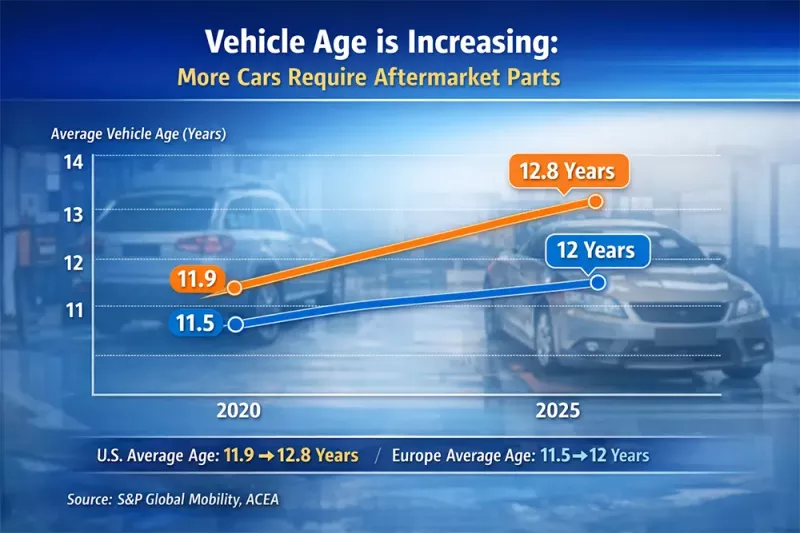

The world’s cars are getting older. According to S&P Global Mobility, the average age of vehicles on U.S. roads has risen to 12.8 years in 2025, marking a historic high. In Europe, ACEA reports an average of around 12 years. This ageing fleet means more vehicles are moving out of warranty and into a segment that requires regular maintenance and parts replacement — a prime opportunity for aftermarket products like wiper blades.

Why Wiper Blades Are a Unique Recurring-Revenue SKU

In markets like North America, Europe, the Middle East, and Southeast Asia, distributors are shifting focus from “new-car growth” to securing parts that rotate fast, restock often, and return cash consistently. Among wear-and-tear components, replacement windshield wipers lead the cycle due to high frequency, relatively low unit cost, and predictable repeat demand.

We make wipers, but we view the category through a B2B lens:

Can this SKU keep turning into cash for years?

Will workshops reorder it without hesitation?

Is the demand stable enough to anchor a product line?

Drivers notice wiper performance immediately—chatters, squeaks, or poor curved-glass contact travel upstream fast. A failed wiper can kill repeat orders; a consistent one nurtures them over the years.

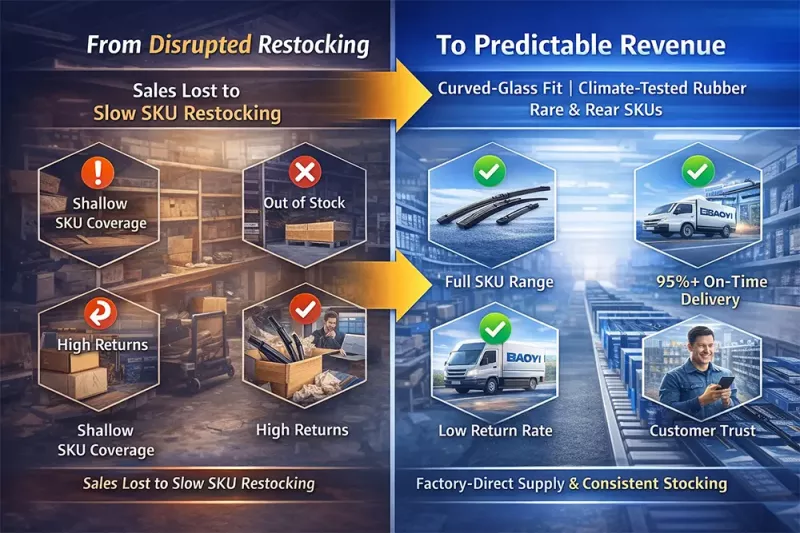

Hidden Challenges for B2B Buyers

1. Unpredictable Lead Times

Disrupting restocking rhythm can complicate warehouse planning and cause stockouts.

2. Quality Inconsistency

Inflates return rates and complaint costs. Hidden costs — logistics, labor for replacements, and lost customer trust — often far exceed unit price.

3. Shallow SKU Coverage

Limits distributors to mainstream sizes, leaving rare and rear-window SKUs underserved, missing revenue opportunities.

The Manufacturing Reality Behind Reliable Wipers

The real purchasing decision comes down to:

“Who can supply aftermarket wipers steadily, minimize returns, and maintain long-tail SKU coverage for ongoing restocks?”

Material Control: Rubber compounds and blade coatings must be defined at the source, not substituted mid-supply.

Predictable Delivery: Not “fast once,” but 95%+ on-time delivery via vertical integration and rolling production plans.

SKU Continuity: Stock coverage for most common EU/NA vehicles, plus rapid small-batch production for rare sizes and rear wipers.

Flexible MOQ: Real B2B restocking is built on agility, not rigidity.

Why Distributors Stay With BAOYI®

Distributors value consistent performance, not low prices:

Quiet NVH behavior

Curved-glass fit

Reliable climate durability (frost and heat)

Shelf turnover without returns

Certifications IATF 16949 & ISO 9001 are baseline trust signals. The real reason orders continue is material control, output stability, and SKU continuity, which protect cash flow and reduce hidden complaint costs.

Long-Game Logic: Aging Cars, Steady Demand

Cars will keep aging. Drivers will keep replacing worn components. Warehouses will keep restocking. Workshops will keep reordering. Margins will keep compounding — as long as the manufacturer keeps the cycle unbroken.

Key Takeaways for B2B Distributors:

Wiper blades are not just consumables — they are recurring-revenue SKUs.

Long-tail SKU coverage turns missed sales into incremental revenue.

Predictable delivery converts warehouse efficiency into tangible margin protection.

Consistent quality converts trust into repeat business.

Partner With Us for Predictable Restocking and Recurring Revenue

For distributors seeking a partner that delivers factory-direct supply, consistent quality, and deep SKU coverage, BAOYI® provides:

Curved-glass wipers

Climate-tested rubber compounds

Rear and rare-size SKUs

Fast small-batch production

Reliable restocking schedules

Hidden complaint costs are minimized, revenue potential is maximized, and both mainstream and long-tail replacement wipers remain available for recurring demand.

Email for catalog & factory quote: enquiry@xmyujin.com