From Overlooked Consumables to Strategic SKU — EVs Are Rewriting the Wiper Blades Market

The global electric vehicle (EV) and hybrid fleet is expanding rapidly. As cabins get quieter, complaints about poor wiping acoustics, unstable pressure, and partial glass contact are becoming more common. What used to be a generic consumable is now a procurement priority for aftermarket retailers, service workshops, and parts distributors. The surge is not only in volume — it is in standards, margin, and SKU specificity.

The market shift is clear: EV owners increasingly report wiper noise and fit issues that generic blades don’t solve.

The opportunity is even clearer for suppliers who think in SKUs, not slogans.

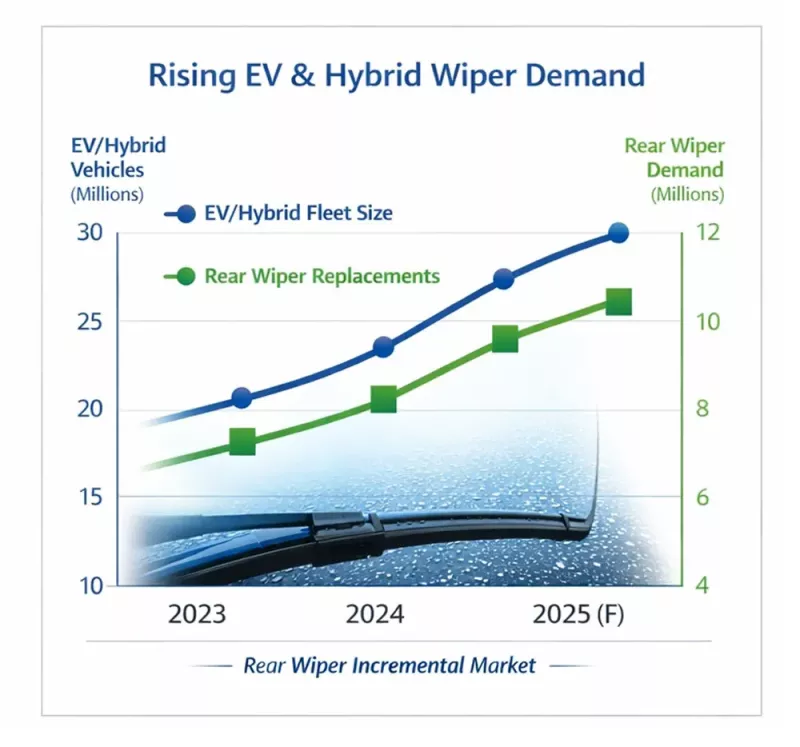

EV Fleet Growth — Compounded Replacement Demand

EV adoption across North America, Europe, and APAC shows a steep climb in registered vehicles. Unlike many traditional parts, wiper blades carry a shorter replacement cycle (6–12 months, depending on climate), and one of the highest reorder frequencies in auto aftermarket categories. For B2B buyers, this means predictable replenishment, year-round demand, and recurring cash flow.

Real-world evidence supports this. A hybrid and EV workshop in Canada noted a steady rise in rear wiper requests, particularly for crossovers and compact EVs. As one shop owner explained: “Sedans didn’t need rear wipers, but EV crossovers do. It’s a new business, not hype.”

New Expectations — Silent NVH, Stable Pressure, and Flawless Arc Contact

EVs create a different sensory baseline. Without engine noise masking, drivers notice squeaks, judder, and micro vibrations far more easily. Meanwhile, EV windshields lean toward larger curvature, aggressive rake angles, and aerodynamic glass profiles to reduce drag. These design shifts expose flaws in traditional pressure systems and generic rubber compounds.

Real EV users are already noticing this. On a Volkswagen ID.4 owners’ forum, one driver wrote: “The (front) wiper blades are horrendously loud … jumping along the surface and generating a lot of noise” even in moderate rain.

Such feedback highlights the importance of better NVH control in wipers for quiet EV cabins.

Engineering solutions for procurement consideration:

Balanced multi-point pressure skeletons outperform single-force frames.

Low-friction coatings (PTFE or equivalent) reduce stick-slip noise and service returns.

Elastic compounds with thermal stability (rubber + hybrid fillers or silicone blends) extend life under UV, frost, and heat cycling.

Another example comes from an MG ZS EV forum, where a user observed: “Replacing original blades with Bosch Aero Twin blades cleaned the windscreen far better than the originals.”

This illustrates how material choice and design directly affect real-world performance.

SKU Opportunities — Where Margin Meets Precision

The EV wiper market introduces new profit zones for B2B channels that understand SKU strategy:

1. Rear Wipers as a Pure Incremental Market

Many ICE sedans never carried rear wipers. EVs and crossovers do. Vehicles like Tesla Model Y/3, Ford Mustang Mach-E, VW ID.4, Hyundai Kona EV, Kia EV6, Rivian R1S, and Toyota Hybrid Crossovers are driving measurable rear-blade volume increases. Most purchased rear sizes cluster around 10″–13″, creating a high-velocity but fragmented SKU band that favors factory-direct supply partners.

2. Brand-Specific Connectors — Coverage Equals Supplier Qualification

Connector diversity has become a gating factor. EV brands deploy unique, modular, or low-profile arms, making full connector libraries a procurement checklist item. Suppliers with complete interface systems secure longer contracts, fewer installation errors, and lower TSR (Total Service Returns).

On Reddit, a VW ID.4 owner noted: “Stock blades screech loudly even when the window is wet, but Bosch Icon blades with the correct adapter solved the problem.”

This reinforces that connector and adapter coverage is a critical supplier qualification metric.

3. Rare Front Size Combinations — A Margin Shield

Non-symmetrical blade pairs (e.g., 26″ + 19″, 28″ + 16″) are increasingly common on EV platforms. These SKUs have low interchangeability but real demand, enabling distributors to avoid price wars and protect margins.

Procurement Checklist — 2025 Action Points for B2B Buyers

| Evaluation Item | Why It Matters | Target Benchmark |

|---|---|---|

| NVH / Noise Control | EVs expose judder & squeaks | < 35 dB in wind-tunnel or rail rig tests |

| Glass Contact Arc | Curved windshields need full sweep contact | ≥ 99% contact over wiping arc |

| Climate Durability | UV, frost, and heat cycles drive service returns | ≥ 12 months in thermal/UV cycling tests |

| Connector Library | Installation accuracy impacts TSR | 95%+ interface coverage for target EV models |

| Supply Model | Inventory risk & missed sales are costly | Factory-direct or ODM small-lot support |

BAOYI®’s factory NVH testing capabilities and patent-backed connector system ensure pressure stability, precise fit, and rear SKU supply reliability, giving B2B buyers confidence in long-term sourcing.

Strategic Takeaway for B2B Decision Makers

EV wiper demand is recurring, expanding, and margin-rich when the SKU strategy is precise.

Quality returns are the real hidden cost — silent, stable, climate-resilient blades reduce TSR and protect reorder contracts.

Connector and rare size coverage are supplier qualifiers, not optional add-ons.

Manufacturers with direct supply channels win more contracts because they close the “rare SKU availability” gap.

The EV aftermarket is not waiting — procurement plans are updating now. BAOYI® supports distributors and parts chains with silent NVH control, high-curvature glass fit, full connector coverage, and rare rear/front SKU production.

For SKU reference sheets, wholesale quotations, or ODM sample requests, contact:

Let 2025 be the year your wiper SKUs stop losing sales and start protecting margins.

Author: Amy Yang

Release Time: Dec 30, 2025

Company: Yujin Xiamen Plastic Manufacturing Co., LTD.