North America is unforgiving to suppliers who can’t quantify failure. Service shops here don’t complain emotionally — they complain economically. A single wiper comeback can cost a shop $40–70 in technician time, fuel reimbursement, and disrupted throughput, depending on region and vehicle type. Multiply that by 20 callbacks a month, and it becomes clear why procurement teams obsess over complaint rates.

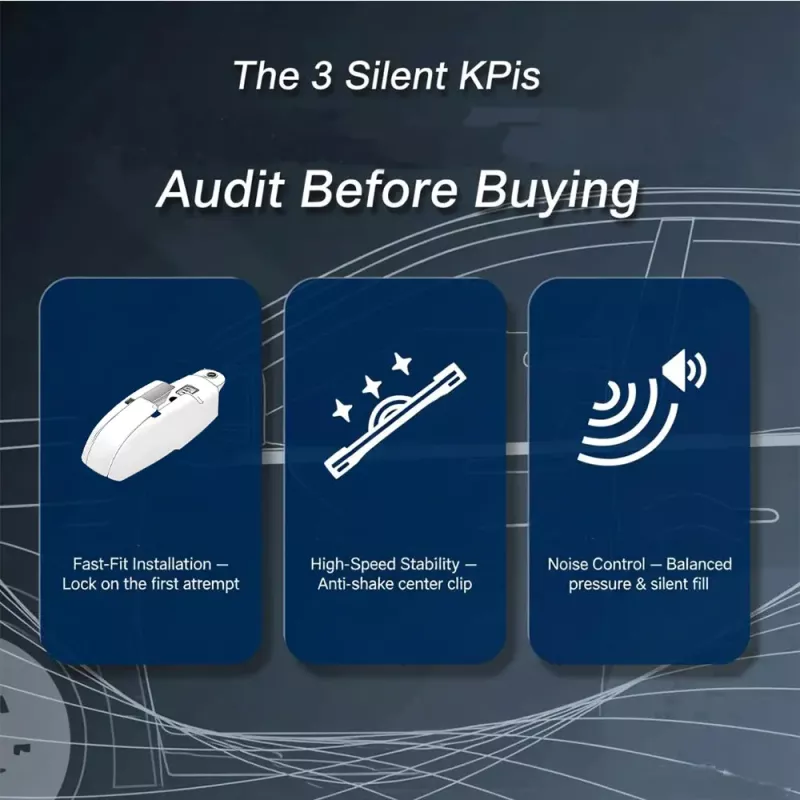

For repair chains and retail-service counters, wiper blades are evaluated on three silent KPIs: install speed, high-speed stability, and noise behavior. The brand printed on the box ranks lower than the return rate printed on the ledger.

Fast-fit adapters that lock on the first attempt

Anti-shake center clips for highway stability

Balanced pressure structures with silent refills to reduce NVH complaints

These factors are discussed across shop-owner communities far more than consumers ever see, shaping purchasing decisions long before brand marketing enters the conversation.

Do you validate adapter tolerance using connector tooling libraries?

Can you provide batch-specific durability test evidence per production lot?

What is your documented return rate over the last six months?

Is your production cadence capable of bulk-SKU fulfillment without manual repacking errors?

These are not rhetorical questions — they function as vendor scorecards in modern procurement evaluations.

Smart distributors balance two forces:

Fast-turn, climate-robust sizes for everyday fulfillment

High-margin rare SKUs for missed-sales recovery without over-stocking

It’s not about stocking more. It’s about stock accuracy.

Workshops and retail chains want parts that technicians trust, customers don’t return, and accountants don’t audit twice. In 2025, the suppliers winning North American purchase orders aren’t claiming to be better — they’re proving to be less returned.

Related Insight:

Procurement standards vary by climate. While North American workshops prioritize silent operation and low return rates, distributors operating in extreme environments face a different set of sourcing challenges.

You may also be interested in our analysis of wiper blade sourcing strategies for hot and abrasive markets:

2025 Middle East Aftermarket Boom: Heat & Sand-Resistant Wiper Blade Sourcing for Distributors

Want to reduce wiper callbacks in your market?

If you’re sourcing workshop-grade, low-complaint wiper blades for North America, feel free to reach out.

Drop us a message via the chat icon or email us at enquiry@xmyujin.com. We’re happy to share batch-level test data, adapter coverage details, and wholesale supply options.